U.S. Public-Private Partnerships in Asia

The Southeast Asia region has been mainly financed by public funds, which are not enough. Governments have started to attract the private sector, offering public-private partnerships (PPP). Private participation is continuously growing, overcoming the challenges encountered. Global foreign direct investment flows remain stable in Asia. The region maintains its position as the largest recipient for FDI worldwide.

Infrastructure development is at different stages throughout Southeast Asia, depending on each country’s policies regarding PPP. Singapore is the country with the most developed infrastructure in this region, and its transportation system, in particular, is well-developed.

A supportive business environment is important for the development of PPP, which is why the macroeconomic conditions of the counties in Southeast Asia should be considered. For 2017-2018, most countries demonstrated good macroeconomic conditions.

PPPs are handled differently throughout the region. Indonesia has worked on reforming PPP legal aspects to improve the process. Thailand also facilitates the procedure to promote PPP investments. The Philippines also show several strengths in PPP programs. It is important to implement efficient guidelines to attract and maintain public-private partnerships.

Infrastructure is an industry that combines management, construction, and financing and which relies greatly on the involvement of the government. Financing infrastructure is challenging and requires investments both from the private and the public sectors.

PPP is not expected to provide great innovation in Southeast Asia, but to help build the infrastructure, push system improvements. The economic development, fiscal management, the development of the capital market and the regulatory framework are four important factors in attracting private capital.

FDI inflows in Asia remained at $476 billion in 2017, with a rise of inflows in China, most ASEAN members, and the Republic of Korea.

In East Asia, FDI inflows were steady at $265 billion. In the free trade zones of the country, FDI increased and China grew faster than other regions. FDI inflows boosted significantly to the high-tech sector, to approximately $40 billion. However, Beijing had a decrease of 11% in FDI inflows. Mongolia, on the other hand, improved its FDI inflows to $1.5 billion in 2017, and with the continuously improving macroeconomic situation, the FDI inflows could keep growing.

In Southeast Asia, FDI inflows increased by approximately 11% to $134 billion, most investments being made in ASEAN countries. Indonesia recorded the biggest increase in FDI, rising to $23 billion. In 2017, FDI grew in manufacturing, agriculture, trade, and finance. Vietnam had a record increase in FDI inflows, with a significant investment rise in real estate and utilities. Myanmar also showed increased FDI flows, by 45%, as its manufacturing sector attracts extensive greenfield investments. Lao People’s Democratic Republic was the only country in the region where FDI inflows declined slightly.

In South Asia, FDI inflows reached $52 billion, with a decrease of inflows in India. FDI in India declined from $44 billion to $40 billion in 2017. Yet, large deals in technological and extractive industries were concluded. An investment group formed by the Microsoft Corporation (United States), eBay (United States), and Tencent Holdings (China) bought a stake for $1.4 billion in Flipkart Internet. Inflows also increased in the Islamic Republic of Iran by almost 50%, as the rich reserves of the country attracted foreign participation in the production and exploitation of oil and gas.

In West Asia, FDI inflows continued to decrease, dropping to $26 billion in 2017. Saudi Arabia, usually the biggest recipient for FDI in the region, had a decline of four-fifths. The political instability in Turkey harmed its economy and on FDI. Inflows continued to decline in 2017, to $11 billion. Jordan, Oman, Bahrain, The United Arab Emirates, and Qatar had an increase in FDI inflows, but not enough to help the region in the decline.

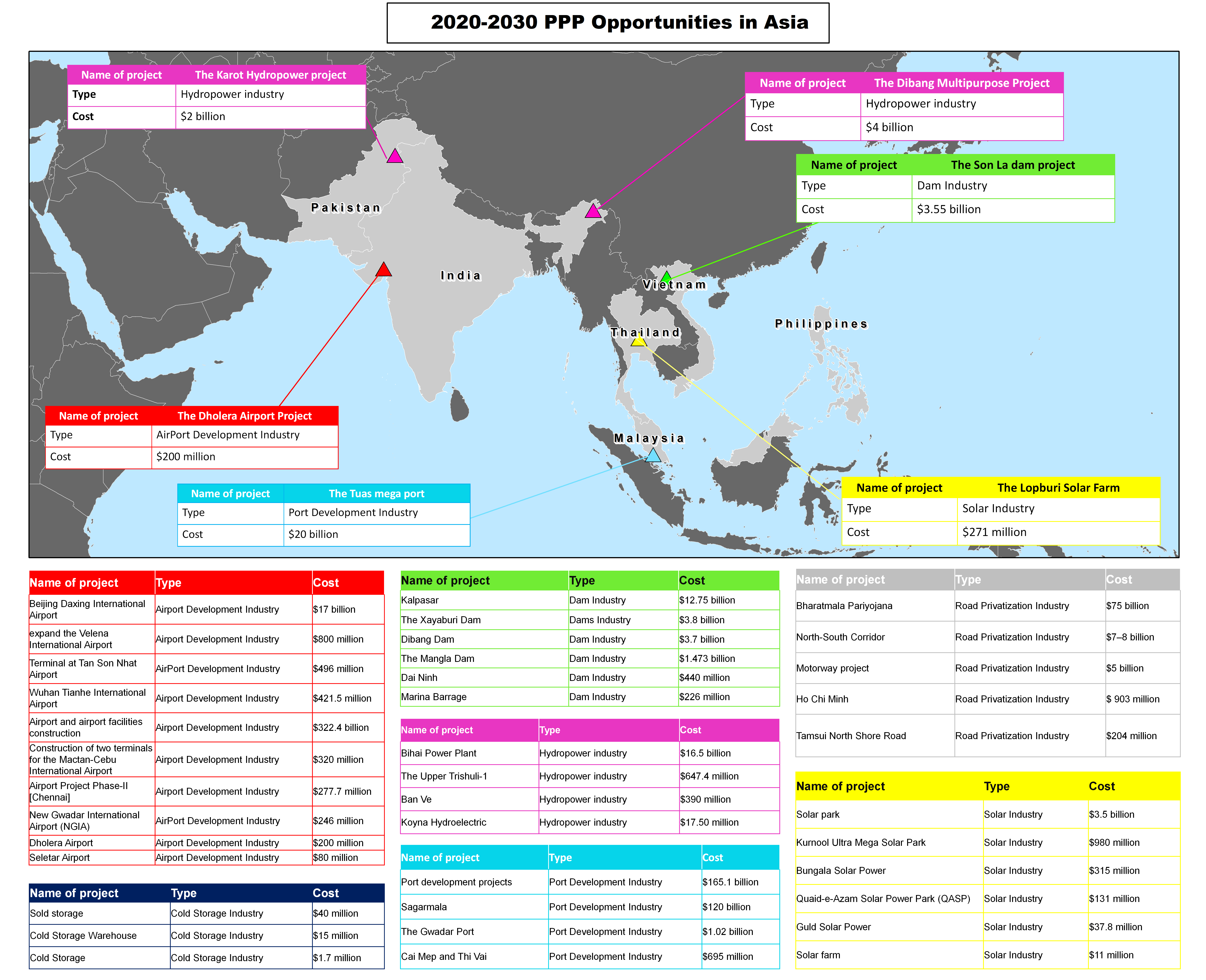

The U.S. – ASEAN investments by 2030

ASEAN is the fourth biggest trading partner for the United States. The U.S. invests in ASEAN member countries three times more than it invests in China and nine times more than it invests in India.

By 2030, ASEAN is estimated to reach an economy of $6.5 trillion and to be the fastest-growing region in the world. ASEAN will be at the center of Asian growth. It already concluded free trade agreements with China, Japan, India, Korea, New Zealand, and Australia.

China has developed strategies for economic integration in Asia and is promoting Chinese standards and objectives. The United States, on the other hand, does not have a reliable framework to trade with ASEAN.

It is time the United States adapted their strategies to compete in emerging Asia. The United States needs to develop a trade policy that also takes into consideration its international customers. They need to take into account the requirements, the culture of the countries, the consumers who will buy their goods and services.

The United States has guaranteed peace and prosperity in Asia since World War II and Asia admits the importance of the U.S. presence in terms of security. With such a long security presence, the Unites States must consider confirming its allies, make new partners and look at the technology, and available resources.

The United States should start investing in the future, by institutionalizing commitment in ASEAN and Asia in general. For example, the president of the United States should attend every year the East Asia Summit, meeting the 17 leaders of the Asia-Pacific countries.

By 2030, the relationship between the U.S. and ASEAN will require an extensive economic engagement that includes India, China, and other big Asian economies. In the meantime, a new group of leaders will rise on both sides and they will need innovative ideas.